Detectives from the Operations Support Unit (OSU) have finally caged a man long on the police radar for masterminding a multi-million-dollar gold scam that duped a foreign investor out of USD 225,968 (KSh 29.6 million).

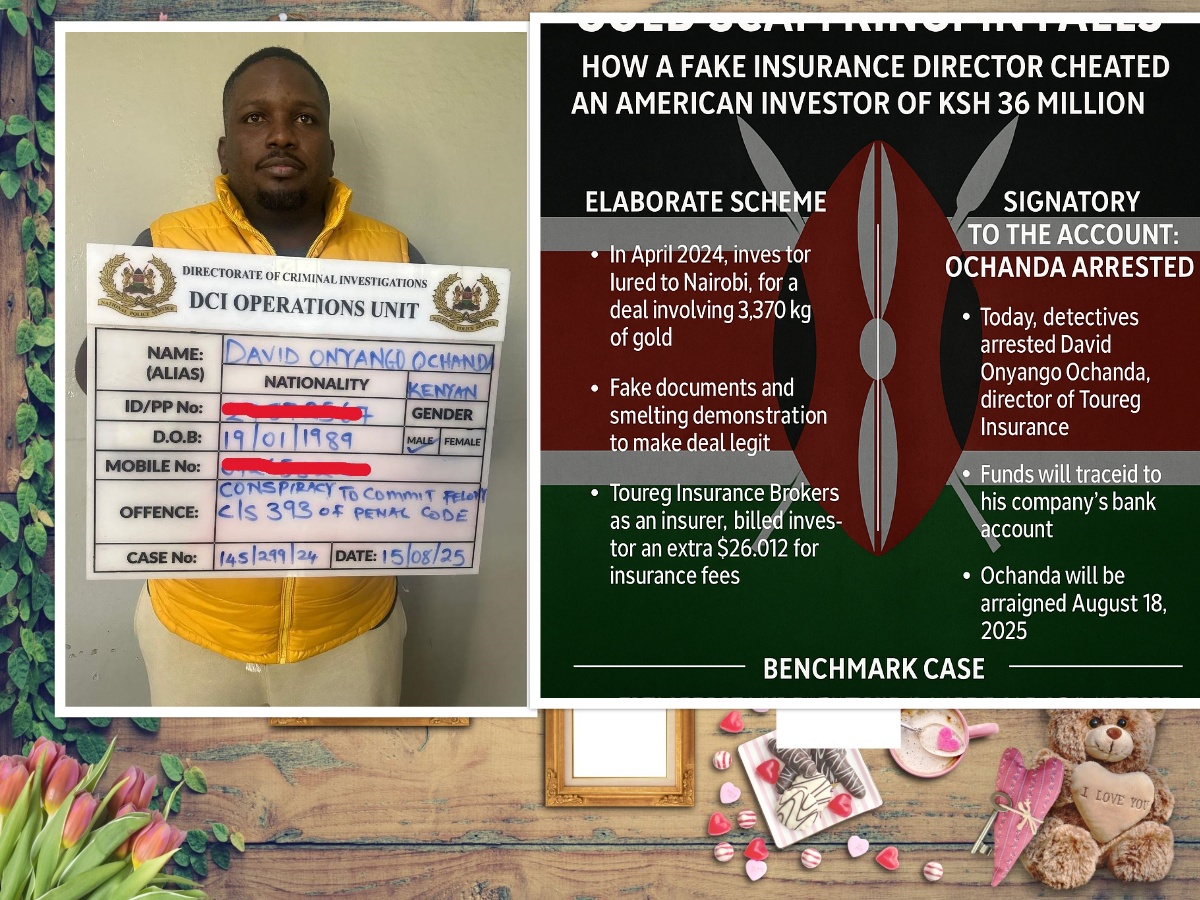

The suspect, David Onyango Ochanda, was arrested in a high-stakes operation after months of investigation. Ochanda, the Director of Toureg Insurance Brokers Limited, is accused of engineering an elaborate scheme that lured an American investor into a fake deal involving the purchase of 3,370 kilograms of gold.

The saga began on April 3, 2024, when the unsuspecting investor flew into Nairobi to finalise what he believed was a legitimate gold transaction. At an office in Gate 53, Chalbi Drive, Lavington, the victim was made to sign a Sales and Purchase Agreement. To cement the illusion, he was even shown a smelting process staged at the seller’s agent’s office — a carefully choreographed act designed to sell the lie.

On April 25, 2024, the agent introduced the investor to Toureg Insurance Brokers Limited, allegedly tasked with insuring the gold during transit. The contact person? None other than David Onyango Ochanda himself. An addendum to the agreement was drafted to include insurance charges, and an invoice was issued for USD 226,012.76.

Four days later, the investor wired USD 225,968.64 to Toureg’s bank account. That was the last he ever saw of his money or the promised gold.

Detectives today confirmed that Ochanda, as the signatory of the account that received the funds, was directly responsible for authorising and benefitting from the fraudulent transfer. He is currently in custody awaiting arraignment at the Milimani Law Courts on Monday, August 18, 2025, where he is expected to face charges of fraud, obtaining money by false pretence, and running a sham insurance front for organised crime.

Police sources describe Ochanda as a key player in Nairobi’s underground gold rackets, using Toureg Insurance Brokers as a cover to fleece unsuspecting investors. His arrest is being hailed as a major breakthrough in the fight against fake gold cartels that have repeatedly dragged Kenya’s reputation in the mud.

As detectives tighten the noose around his accomplices, questions remain about how a licensed insurance brokerage firm could be turned into a vehicle for international fraud — and who else within its operations may have enabled the scam.

For now, one thing is clear: the gold scammer who thought he could stay untouchable is finally behind bars, and his arrest sends a chilling message to Kenya’s booming fraud networks — their time is running out.